Category: Financial Advice

-

Reconciling Accounts

Can you recall the last 10 transactions you made with your credit card and match them with your latest statement? Probably easy, right. Now say you have 100 transactions for the last period, how comfortable will you be not doing some sort of reconciliation to ensure your billing statement is correct. Why is reconciliation important?…

-

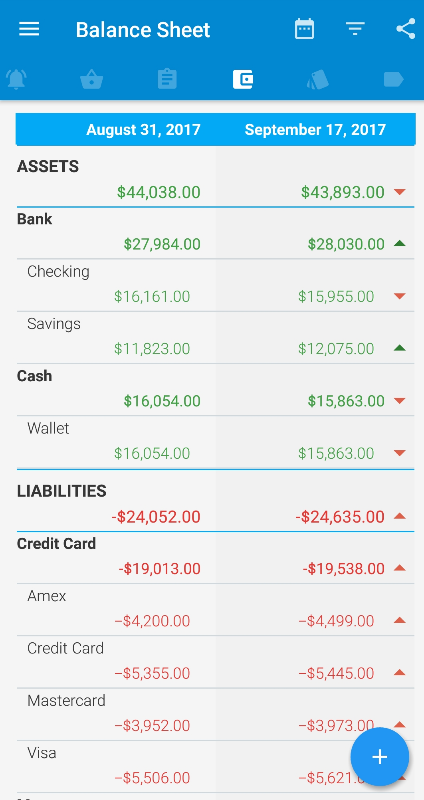

Balance Sheet

Introduction A balance sheet calculates your net worth by comparing your financial assets (what you own) with your financial liabilities (what you owe). The difference between the two is your personal net worth. Net Worth = Assets – Liabilities Assets Assets can be classified into three distinct categories: Liquid Assets: Liquid assets are those things…

-

How to Manage Debt and Loans

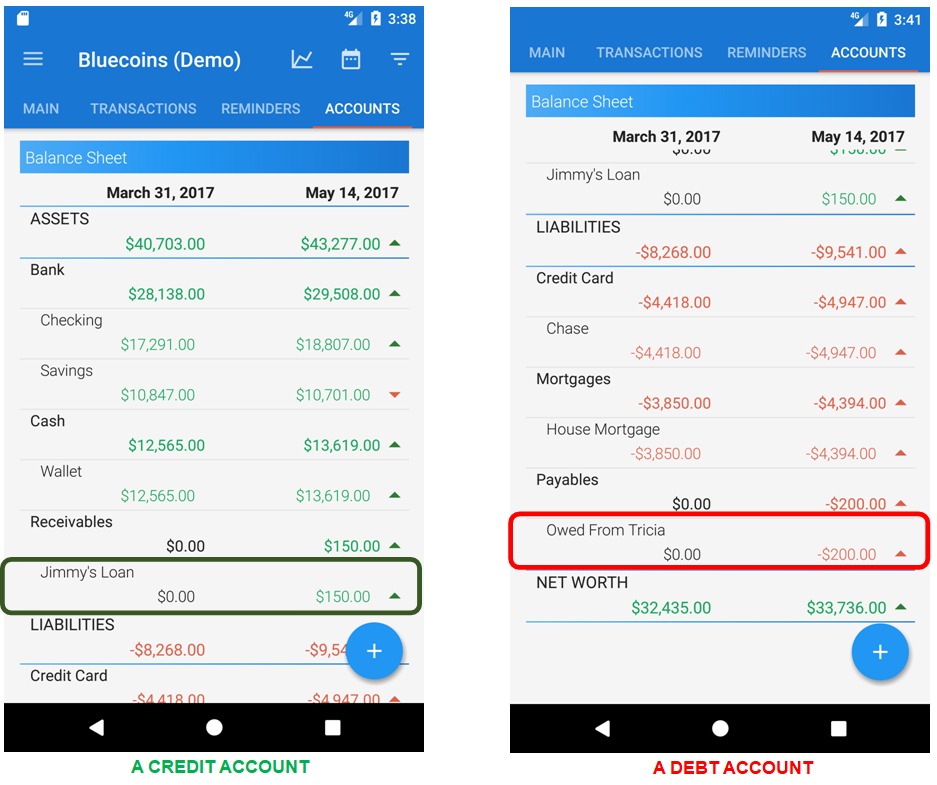

I got this question at least a few times and thought I’ll write a few notes about how to effectively track debts (money you owe from somebody) and credit (money you loaned to somebody) using Bluecoins. First off: debts and credits are part of your net worth, and they should be managed as such I…

-

Rethinking Credit Card Expenses

A lot of users around the world have asked me why doesn’t Bluecoins treat credit card payments as expense? Bluecoins uses standard accounting principles all throughout the app. Based on these principles, payments to credit cards from your bank or checking accounts is simply a way of journal-ling movement of funds from one account to…

-

What is Cash Flow?

Sometimes, just looking at your net earnings or how much your income exceeds your expenses is not enough to tell you whether you can afford to buy that dress or even pay for that monthly payment for a new car. If your child for example comes to you and says that he wants to go…

-

How Bluecoins Help You Evaluate Your Financial Statements

Bluecoins provides you with features that enable you to easily evaluate your personal financial status. The more you understand your personal finance situation, the more effective you are in making financial decisions and preparations that ultimately leads to a more financially healthy lifestyle. I ran into the following article from Investopedia that explains further: Month…