This post describes how to setup and manage a credit card account in Bluecoins.

How to Create a Credit Card Account

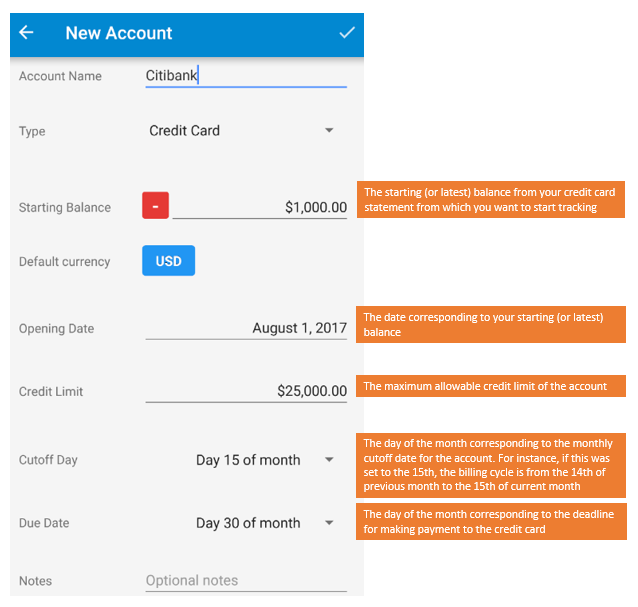

To create a credit card, on the Accounts Screen (Navigation Drawer > Accounts), click the Add icon. On the next screen, under Type, select “Credit Card”, then fill up the fields that will show up based on your credit card account information.

- Starting Balance– The starting (or latest) balance from your credit card statement from which you want to start tracking.

- Opening Date– The date corresponding to your starting (or latest) balance. This does not have to match your billing date.

- Credit Limit– The maximum allowable credit limit of the account.

- Cutoff Day– The day of the month corresponding to the monthly cutoff date for the account. For instance, if this was set to the 15th, the billing cycle is from the 14th of previous month to the 15th of current month.

- Due Date– The day of the month corresponding to the deadline for making payment to the credit card.

Credit Card Summary

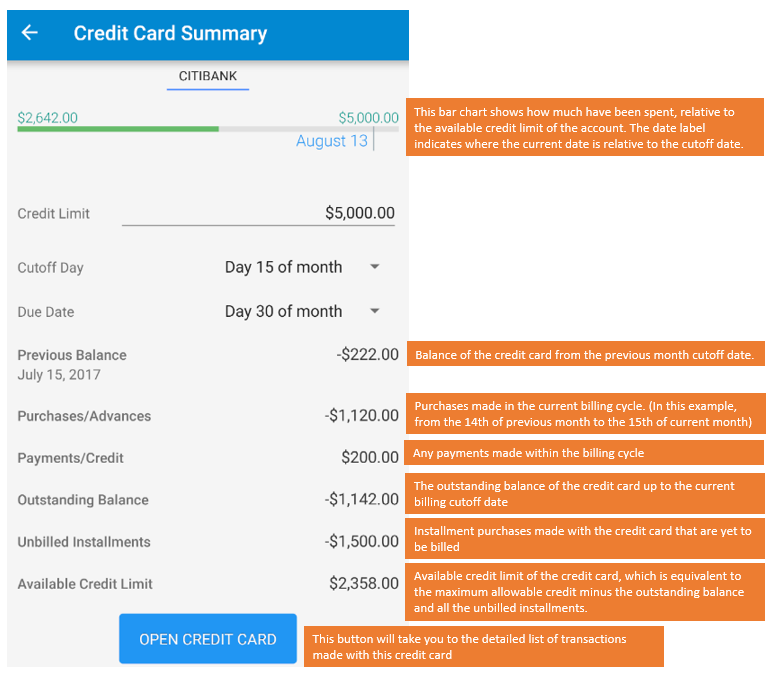

When you click on a credit card on the Balance Sheet, or on the Credit Card Summary tab on the Main Dashboard, you will be presented with the following summary screen:

- Bar Chart- the bar chart shows how much have been spent, relative to the available credit limit of the account. The date label indicates where the current date is relative to the cutoff date.

- Previous Balance- balance of the credit card from the previous month cutoff date.

- Purchases/Advances- purchases made in the current billing cycle. (In this example, from the 14th of previous month to the 15th of current month)

- Payments/Credit- any payments made within the billing cycle

- Outstanding Balance- the outstanding balance of the credit card up to the current billing cutoff date

- Unbilled Installments- installment purchases made with the credit card that are yet to be billed

- Available Credit Limit- available credit limit of the credit card, which is equivalent to the maximum allowable credit minus the outstanding balance and all the unbilled installments.

- Open Credit Card- this button will take you to the detailed list of transactions made with this credit card

How to make installment purchases

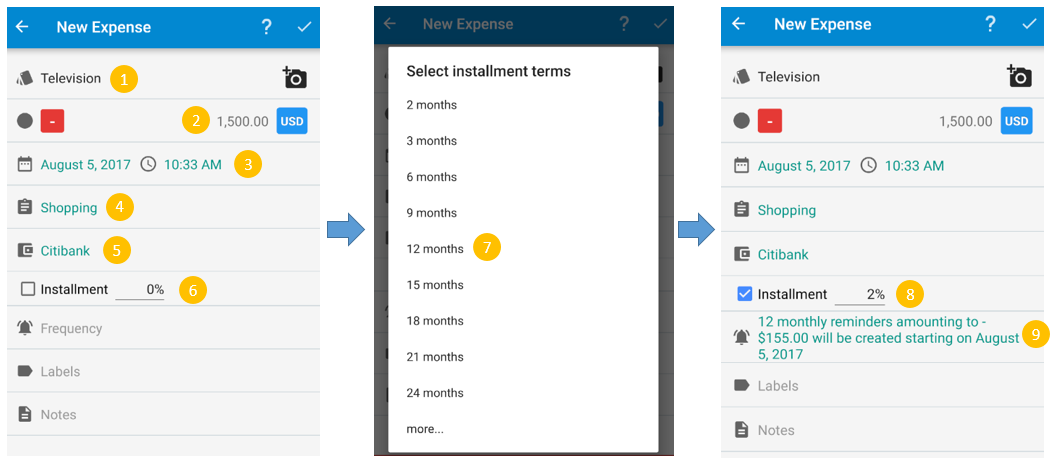

To make installment purchases with a credit card:

- Open a new transaction, and record the name of the purchase

- Set the date on when the first installment will be charged to the credit card

- Enter the full amount of the purchase

- Set the desired category

- Select a Credit Card Account

- Check the Installment Checkbox

- Select the installment in terms of number of months

- Set the credit interest percentage rate, if any, for the purchase

- Review the summary to make sure everything is in order

How to record payments into a Credit Card

To record a payment to a credit card, simply make a transfer from your payment account (example- Bank or Savings Account) to your Credit Card account. Bluecoins will automatically recognize this type of transactions as payments and will be reflected on the Credit Card Summary described above.

To learn more about transfers, please www.bluecoinsapp.com/transfers.