Can you recall the last 10 transactions you made with your credit card and match them with your latest statement? Probably easy, right. Now say you have 100 transactions for the last period, how comfortable will you be not doing some sort of reconciliation to ensure your billing statement is correct.

Why is reconciliation important?

Reconciling bank accounts, including credit cards in Bluecoins is one of easiest way to ensure your financial data is accurate. Reconciling a bank or credit card statement simply means comparing your accounting records (such as those you enter in Bluecoins)—and matching them up to the corresponding transaction as listed on your statement. Simply put: what’s in your accounting system versus what’s in the bank. You want to ensure that your not getting charged more than what you paid for. While credit card companies are reliable in keeping track of your purchase records, it’s still possible some clerical errors happens along the way. Or some bad person used your card inconspicuously.

How to Reconcile in Bluecoins

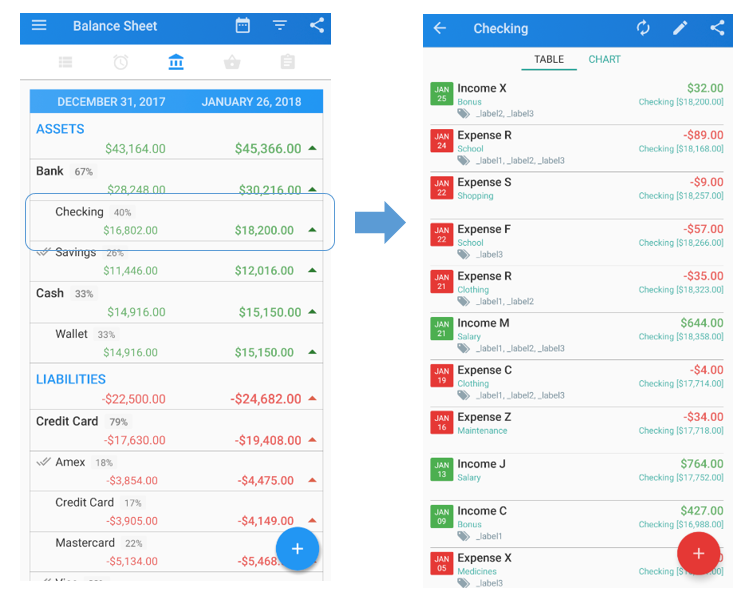

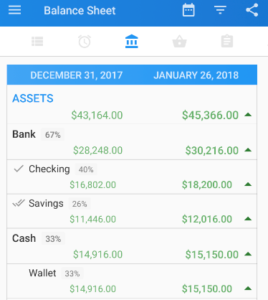

- Click on the account you want to reconcile on the Balance Sheet.

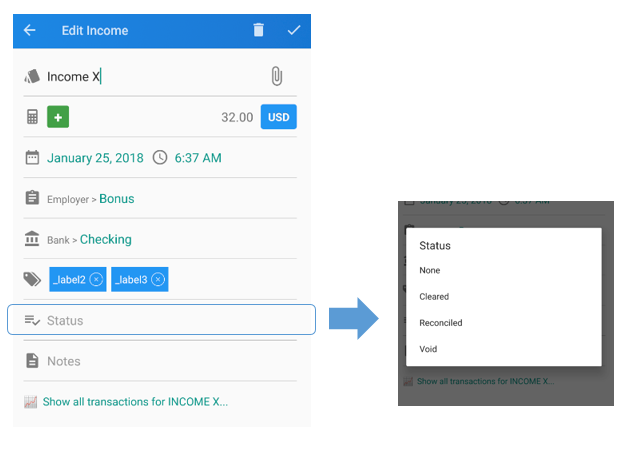

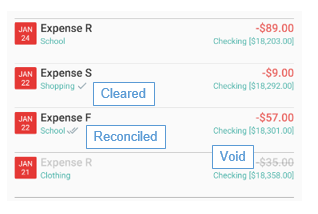

- On the table tab, click a transaction and assign a status. The following status are available:

- None (or Uncleared) means nothing, for instance, you just entered this transaction and have no official confirmation of it.

- Cleared state can be assigned if you know that the transaction really has happened. For example, if your bank shows it at the web site you can assign cleared state to the transaction.

- Reconciled is the last state in transaction lifestyle. Usually you move several transactions from cleared to reconciled state at the end of the month based on the bank statement.

- Void means the transaction is no longer valid and will not be going through your accounts.

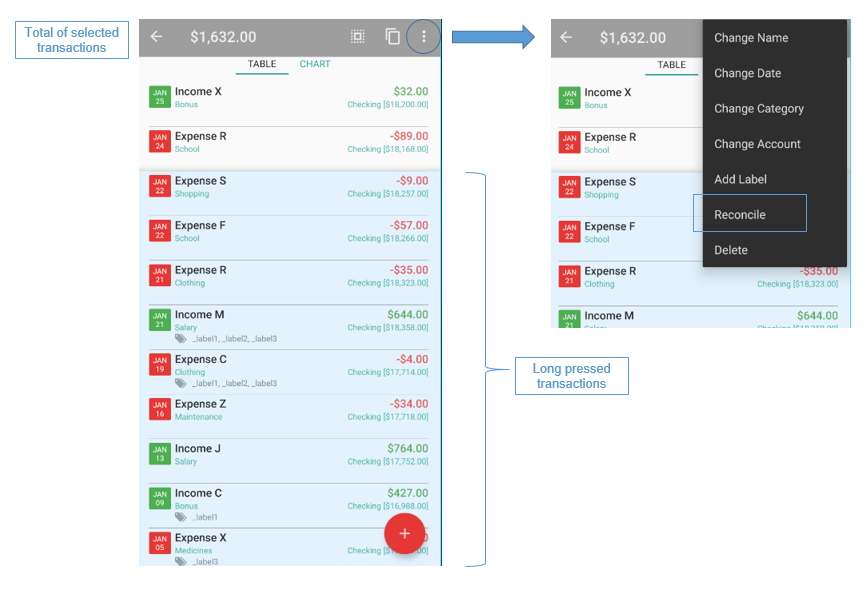

- To reconcile multiple transactions at the same time, long press the transactions you want to assign a status on.

- A transaction marked as cleared will have a single check-mark icon attached to it. Consequently, a transaction marked as reconciled will have a double check-mark assigned to it. A void transaction will have it’s amount striked-out.

- Similarly, on the balance sheet, an account that is fully reconciled or have all transactions already reconciled will have a double check-mark assigned to it. Similarly, an account that is not fully reconciled but has all transactions either marked reconciled or cleared will have a single check-mark assigned to it.

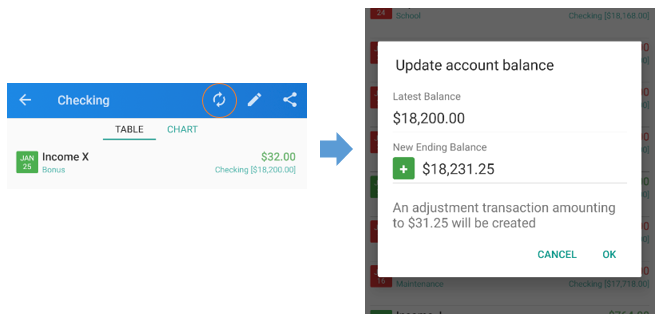

- If the accounts are off by a few amount and you need to jump ahead and update your records to match the bank records, use the update account balance feature by clicking the 2nd menu icon at the top right. Bluecoins will calculate the difference between your accounting records and the statement and automatically create a transaction for you matching that difference.