Introduction

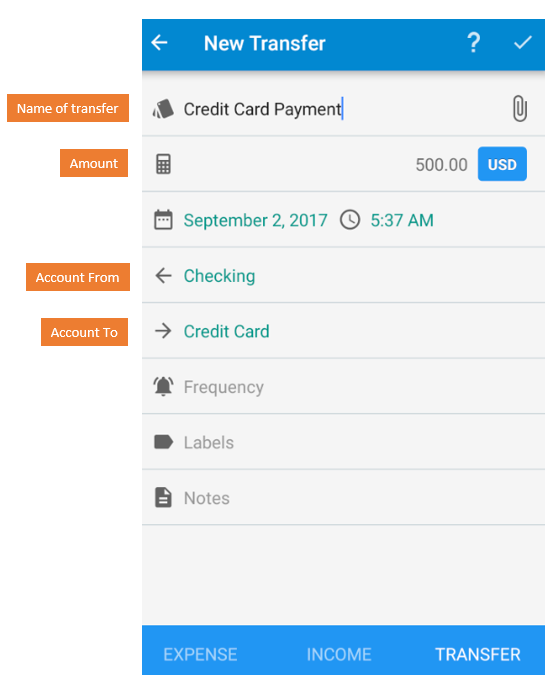

To make a transfer in Bluecoins, on the main screen, click the add button, and on the bottom toolbar, select Transfer.

On the screen that follows, enter the name of the transfer, amount, and the accounts involved on the transfer.

- The first account (Account From) is the debit account, the account you are taking money from.

- The second account (Account To) is the credit account, the account you are crediting the money to.

When you save this transaction, on the Transaction tab, there will be two rows created.

The first entry is the debit transaction (as indicated by the negative amount) and the next transaction is the credit transaction (as indicated by the positive amount).

Where to Use Transfers

There are multiple reasons why you would use Transfers instead of Expense or Income transactions. Examples of this would be withdrawals from your ATM to your Wallet account, credit card payment like the example above, reflect mortgage payments or for loan and debt management. The following links describes this in more detail:

Why Do Transfers have No Categories in Bluecoins

Bluecoins relies heavily standard accounting principles that is well recognized around the world. Transfers, or moving money from one account to another, such as making payment to your credit card from your bank account, is simply a means of journal-ling movement of funds from one account to another. The expense was made when the credit purchase was incurred. Paying off the debt does not have any impact on your net worth or bottom-line as expense or income would, because this would simply lead to a corresponding equivalent reduction in both your asset and liability, resulting to zero net impact (difference between assets and liabilities).

Consider this example, assuming for all intents and purposes you only maintain 2 accounts, a checking and a credit card account.

- Before transfer

- Checking Account Balance = $1000

- Credit Card Balance = ($200)

- Net Worth = $800

- After transfer (Checking to Credit transfer of $150)

- Checking Account Balance = $850

- Credit Card Balance = ($50)

- Net Worth = $800

As you see, your net worth is the same before and after the transfer was made. So transfers are not expense, and thus not categorized and would not show up in the Net Earning report generated in Bluecoins just as expenses and incomes would.

But I really want to categorize my transfers?

Well, in that case, the recommended option is for you to create two transactions consisting of a positive and negative amount transactions (expense or income) that would offset each other. The following is an example of a dual expense transaction (one is negative amount, the other is positive) that offsets each other.

Transfers Fees

Bluecoins support including transfer fees for transfers transactions. To read about this feature, read the following link: